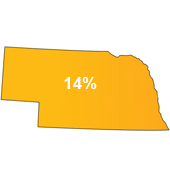

In Nebraska, the interest rate is 14% and the redemption period is 3 years. All counties have their tax lien certificate sales in March. They also have it through competitive bidding and bidders can even send their bids before the sale through mail. Also, interested buyers can ask for unsold tax lien certificates which can be bought throughout the year over the counter.

In Nebraska, the interest rate is 14% and the redemption period is 3 years. All counties have their tax lien certificate sales in March. They also have it through competitive bidding and bidders can even send their bids before the sale through mail. Also, interested buyers can ask for unsold tax lien certificates which can be bought throughout the year over the counter.

Featured Article

How to Pick Properties for Tax Deed Sales?

Are you getting ready for a tax deed sale? Choosing the right properties is key to success. Follow these simple steps to get started.

Step 1: Build Your Property List

Start…

Learn More About Partnering with Me on Deals!

Need some help Getting Started With Tax Liens & Deeds? I’ve got a couple of steps for you here: Get Your Free Book: Click here to get your FREE copy of the ABCs of…

The #1 Trait You Need To Make Tax Liens & Deeds Work

In today’s video Dustin Talks about how to become successful in your tax lien and deed investing.

Watch today’s video to learn about ways to make sure that you’ll be successful…

Buy Tax Lien & Deed Property For Pennies On The Dollar Quickly Get the Free Mini Course Here $197 Value (Free)

Get A Tax Sale Deals Up To 90% Off in 30 Days or Less! Schedule A Free Call For Hand Holding Help

Avoid Costly Rookie Tax Sales Mistakes Book A Call For 1 on 1 Mentorship To Save 3 Years Of Trial & Error

Subscribe to my Youtube Channel for Weekly Updates