Last Updated on October 23, 2025

Table of contents

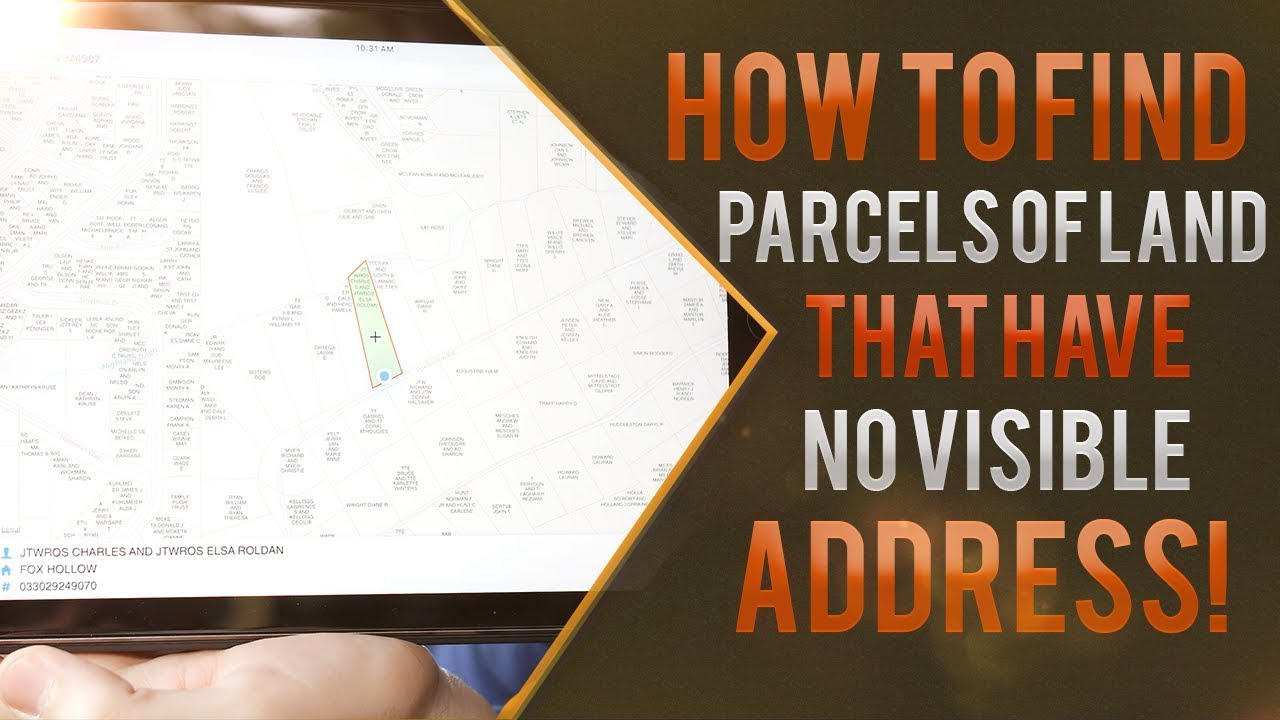

Have you ever struggled with finding land without an address at a tax deed or lien auction? Maybe all they provided was a cryptic number or just a street name with no house number. It’s a situation many of us encounter, and it can make tax sale investing feel like a wild goose chase.

In today’s VLOG, we’re addressing the challenge of finding land without an address and how to use tools to identify the correct parcels. We’ll walk you through how we used one game-changing app to pinpoint exactly what we were dealing with. This tool is an absolute must-have for tax lien and deed investors.

Using Tech to Clarify Land Without an Address

We came across a valuable piece of land at a tax sale this week. On the surface, it seemed like an incredible opportunity. But without exact details, you could end up with a useless slice of a driveway or an oddly shaped forest patch. That’s where this app comes into play, it helps identify the exact property being auctioned. This tool has saved us countless headaches by ensuring we know precisely what we’re bidding on.

How to Find Land Without an Address

Some tax‑lien investors look at empty lots or rural land that do not have street addresses. Locating these parcels can be confusing, but it becomes easier once you know how local governments number and map land. This guide uses basic English to explain those numbers and outline simple steps you can follow.

Parcel Numbers

Counties use special numbers instead of addresses to identify property. These may be called an assessor’s parcel number (APN), tax ID, parcel number or property identification number (PIN). Whatever the name, each code belongs to only one piece of land. An APN is simply a unique number assigned to each parcel by the county tax assessor, and these codes follow a set format rather than being random. In other words, a parcel number is a unique identifier assigned by the county to track a property.

Simple Steps to Find a Land Without Address

- Collect what you know.

Look for any clue: the parcel number from a tax sale list, the owner’s name, the county and state, or nearby landmarks. If you have a legal description, keep it handy.

- Check the assessor’s website.

Most counties let you search by parcel number or owner name. Enter the number exactly, and read the record for acreage, use and possible map links.

- Use a GIS map.

Many counties have a GIS (Geographic Information System) viewer. Type the parcel number to see the property outline on an aerial image. This shows size, shape and nearby roads.

- Cross‑check with online maps.

Copy the coordinates from the GIS tool and paste them into Google Maps or Google Earth. Satellite images help you see terrain and road access.

- Read the legal description or plat map.

If you cannot find a map, use the legal description (sections, townships, lot numbers) to search county plat maps. These drawings match numbers to the physical location.

- Ask the county office.

When online tools are not enough, call or visit the assessor or recorder. Provide your clues and ask for help locating the parcel.

Tips for Finding Land Without an Address

- Confirm property details. Double‑check the lot size, zoning and taxes before bidding on a lien or deed. Errors can be expensive.

- Look for access. A parcel without a road or legal path may be hard to use or sell. Use maps to see if a road reaches the land.

- Inspect if possible. Online maps are helpful, but seeing the land in person shows terrain, vegetation and any issues. If you cannot visit, consider hiring someone locally.

Quick Reference Table

| Task | Resource | Why it helps |

|---|---|---|

| Identify the land | Parcel number (APN/PIN) | Unique ID used by the county |

| View tax record | County assessor website | Search by ID or owner and see property details |

| See property outline | County GIS map | Highlights parcel boundaries on a map |

| Check location | Google Maps/Earth | Shows satellite images and roads |

| Verify description | Legal description & plat map | Matches written details to the map |

The $126,000 IRS Lien Scare

During this particular tax sale, while finding parcels of land with no address, we discovered that the property in question had over $126,000 in IRS liens attached to it. Imagine the disaster that could have unfolded if we hadn’t done our due diligence! We’ll break down how we navigated this tricky situation and avoided what could have been a costly mistake.

FAQs

Use the section, township and range or lot and block numbers to search county plat maps. If you cannot find it online, call the county office.

Yes. Counties use different names, but they all refer to the unique code that identifies a piece of land.

Conclusion

Finding land without a street address is possible when you understand parcel numbers and use county tools. Collect any information you have, search the assessor’s records and maps, and ask for help if needed. With practice, you will feel more comfortable evaluating tax‑lien and tax‑deed properties.

Watch, Learn, and Avoid Costly Mistakes

This video is packed with valuable lessons to help you avoid similar pitfalls in your tax lien and deed journey. Don’t miss out on the insights that could save you from a financial nightmare.

Finding land without an address doesn’t have to be a nightmare if you have the right tools and strategies.

PS: I’m giving away FREE auction trips just like this one when you join TFB today. But hurry—this video is only available for a limited time. Click here to learn more.