Last Updated on September 9, 2025

Table of contents

A tax lien is a legal claim the government places on a property when the owner owes property taxes, giving the lien holder the right to collect the debt plus interest. A tax deed transfers ownership of the property to the buyer after the tax sale, often without waiting for the owner to repay the debt. The choice between the two depends on the state and your goals as an investor.

A tax lien lets you earn interest while waiting for the owner to redeem the property. In most states, liens are the first‑priority claim on a property. Tax deeds, by contrast, give you ownership once you pay the back taxes, subject to any redemption period. Understanding both tools, including hybrid states that combine features of each, helps you decide which strategy fits your risk tolerance and timeline.

What is a Tax Lien?

A tax lien is a legal claim imposed on a property to secure payment of delinquent taxes. When a homeowner fails to pay property taxes, the county or municipality sells the lien to investors at a public auction. The investor pays the outstanding taxes and, in return, holds the lien. Liens usually have first priority, meaning they must be satisfied before mortgages or other debts.

- Earning interest: The state sets a penalty or interest rate that the homeowner must pay to reclaim the property. Interest rates vary widely – some states set rates as low as 8 percent, while others allow rates over 20 percent.

- Redemption period: After the sale, the homeowner has a redemption period (often 1–3 years) to pay back the taxes plus interest. If they redeem, you receive your investment plus the interest. If they fail to redeem, you can initiate foreclosure and obtain the property.

- Risks and considerations: You do not own the property until foreclosure, so you cannot enter or improve it. You also need to research other liens and budget for title‑clearing services.

What is a Tax Deed?

A tax deed sale transfers ownership of the property to the winning bidder once they pay the back taxes. In a pure tax‑deed state (e.g., California or Idaho), you take control immediately after the auction. You can sell the property, rent it out or live in it.

- Redemption rights: Some tax‑deed states have a short redemption period (often 30 days or less). If the former owner pays within that window, you must return the deed but usually receive your purchase price plus an interest penalty.

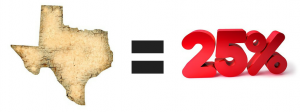

- Hybrid states: In hybrid states like Texas, you receive the deed but must wait through a redemption period (e.g., 6 months) before having clear title. If the owner redeems, you earn a fixed return (Texas pays 25 percent interest, regardless of how soon the owner redeems). If they do not redeem, the property becomes yours free and clear.

How Do Redemption Periods Work?

The redemption period is the window during which the property owner can repay the taxes and reclaim the property. For tax liens, redemption periods typically range from one to three years. For tax deeds, redemption periods—if any—are much shorter and vary by state. Washington allows eight months, Oregon and New York allow two years, while California offers no redemption period. Investors should consult the county’s tax sale list and state statutes to confirm the timeframe and interest rates.

Comparing Tax Liens and Tax Deeds

| Aspect | Tax Lien | Tax Deed |

| What you buy | The right to collect unpaid taxes plus interest; you do not own the property. | The deed (ownership) of the property. |

| Income source | Interest/penalty paid by the property owner during the redemption period. | Potential resale or rental income; in hybrid states you may also earn interest if the owner redeems. |

| Redemption period | Typically 1–3 years. | None or very short (often ≤30 days). |

| Foreclosure | Required if the owner does not redeem; you must obtain clear title. | Generally not required; deed transfers ownership immediately subject to redemption rights. |

| Risk level | Lower; you earn interest even if the owner redeems. | Higher; you take on property‑ownership risks such as maintenance, liens and market fluctuations. |

Pros and Cons for Investors

Tax Liens

- Pros: Lower entry cost, interest income, first‑priority claim on the property, and the possibility of eventual ownership.

- Cons: Longer wait before realizing returns; you cannot inspect or use the property; you must handle foreclosure if the owner defaults.

Tax Deeds

- Pros: Immediate control of the property and potential for significant gains if you sell or rent at market value.

- Cons: Higher costs, potential title issues, and responsibility for repairs, taxes and insurance.

Frequently Asked Questions

If a homeowner doesn’t pay what they owe on time, you can foreclose and acquire the property free and clear

Tax liens are usually the #1 priority claim on a property, which may wipe out lesser liens like mortgages

It depends on what you’re after. Tax liens can give you a steady interest income and are generally lower risk, while tax deeds let you grab property right away and might bring in a higher return

Each state sets its own rules. Some of the states offer 8% penalties, while others, like Illinois, can reach 36%. The Redemption periods typically range from one to three years.

Yes. In hybrid states, you receive a deed but must wait through a redemption period. If the property redeems, you earn interest; if not, you gain the property

Next Steps and Resources

Ready to start? Download our Free Tax Lien & Deed Investing Mini‑Course and schedule a free strategy call to discuss your first deal. Our team has over 22 years of experience and hundreds of successful transactions. We’re here to help you navigate auctions, evaluate redemption periods and avoid costly mistakes.