Last Updated on October 23, 2025

Table of contents

Need some help Getting Started With Tax Liens & Deeds?

I’ve put together a simple plan to help beginners get started with tax liens and deeds. These steps apply anywhere in the United States. If you partner with me on deals

Step 1 – Learn the Basics

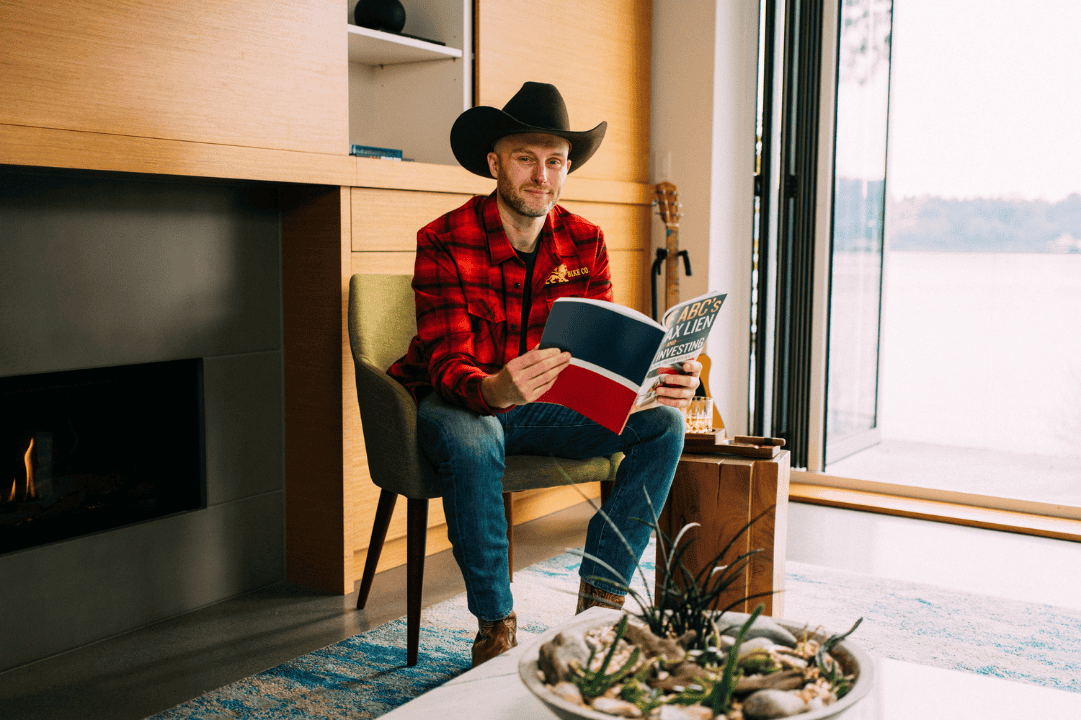

Grab a free copy of my ABCs of Tax Lien Investing. It explains in simple terms how liens and deeds work, the risks you need to watch for, and the rewards that make this a powerful strategy.

Step 2 – Book a Free Call

Set up a free call with me and my team. Click Here To Get a custom investment plan that fits your goals and walks you through what you need to know before you start bidding.

Step 3 – Check the Auction Calendar

Use my auction calendar to see upcoming tax sales. Rules, dates, and formats vary by county, so knowing what to expect before you bid is key.

Step 4 – Use Free Tools

On my site, you’ll find guides, checklists, and worksheets to help you research properties and make smart decisions before investing.

Why Tax Liens & Deeds Matter?

A tax lien is a legal claim placed on a property when the owner fails to pay property taxes; the lien stays with the property until the debt is cleared. Investors can purchase these liens at auction and collect the debt plus interest, rates that often exceed traditional bank yields. When the homeowner does not repay, the investor may have the chance to foreclose and acquire the property.

A tax deed allows the county to sell a property outright when taxes go unpaid. Rocket Mortgage notes that tax deeds give investors an opportunity to purchase homes below market value. North Carolina is one of the states that uses tax deeds and offers no redemption period. This means that once the auction is complete and the buyer pays, the previous owner cannot reclaim the property by paying back taxes.

Why Consider Partnering with Me on Deals?

I’ve been investing in tax liens and deeds for more than 22 years. Over the years, I’ve closed hundreds of deals and built taxlienschool.com to help new investors. I also run the #1 YouTube channel on tax liens and deeds with over 98,000 subscribers and thousands of videos.

My program focuses on finding properties at a deep discount—sometimes up to 90% off market value. In some states, liens pay high interest rates, while in others, you can gain full ownership of a property through the deed system.

What Can You Expect When You Partner with Me on Deals?

Step-by-step guidance – I’ll help you review deals, understand auctions, and handle paperwork so you avoid costly mistakes.

Clear direction – I’ll explain the process, rules, and timelines so you know exactly how it works before you invest.

Supportive community – You’ll connect with other investors who share tips, strategies, and encouragement along the way.

Opportunities and What to Watch For

Tax liens and deeds are one of the lowest-cost ways to start in real estate, but you must do your homework.

Check property condition – Some properties may need major repairs, so always research carefully.

Know redemption rules – Every state has different laws. In some places, owners can pay back taxes and keep the property.

Balance risk and reward – Returns can be high, but so can the risks. Do your research, plan ahead, and diversify to stay safe.

People Also Ask (FAQs)

A tax lien is a claim against a property when taxes are unpaid; investors purchase the lien and collect the debt plus state‑specified interest. A tax deed sale transfers ownership of the property to the highest bidder once taxes remain unpaid. North Carolina uses tax deeds, not liens.

Interest rates on tax liens vary by state from 4 % to 36 %. Tax deed investors do not earn interest; instead, they may acquire property below market value. Returns depend on the sale price, rehabilitation costs and eventual resale or rental income.

Once taxes are delinquent for a specified period, the county schedules an auction. Because there is no redemption period, title transfer happens soon after payment. Closings are generally faster than in states with redemption periods.

Dustin Hahn is a tax lien and tax deed investor with over 22 years of experience and the founder of Tax Lien School. He teaches investors how to buy properties up to 90 % below market value and earn high yields. His YouTube channel has tens of thousands of subscribers and offers free education.

Yes. Getting Started With Tax Liens & Deeds often requires modest capital, and educational resources like the ABCs of Tax Lien Investing guide and Dustin Hahn’s training can help you get started. Always research local laws, particularly if you live in a tax deed state such as North Carolina.

Start Your Journey Today

Learn More About Partnering with Me on Deals! The opportunities in tax lien and tax deed investing are real, but success requires education and due diligence. Download the ABCs of Tax Lien Investing guide, schedule a free call with me and my team, and explore the auction calendar.

Partnering with an experienced mentor like Dustin Hahn can help you navigate local auctions and potentially secure properties below market value.